2023. 04. 06

Brite Energy Partners (BEP) announces its first solar PPA in Korea- BEP has signed its first REC supply contract with Mirae Asset Securities.

- Companies are lured by BEP's long-term contract implementation, asset ownership, and direct operation.

- Driving the implementation of RE100, BEP stands out despite the regulations.

Brite Energy Partners (“BEP”) has announced that it executed the REC supply contract with Mirae Asset Securities last month. BEP owns and operates one of the largest solar portfolios in Korea, while Mirae Asset Securities is Korea’s largest brokerage firm and has been working with BEP to secure clean electricity to comply with the RE100 initiative.

The REC supply contract between BEP and Mirae Asset Securities has been marked as one of the rare examples in which a private renewable energy asset owner sells RECs to a private off-taker, particularly when in Korean market solar asset owners usually chooses to sell RECs to Korean government owned utilities on 20-year fixed price contracts awarded via semi-annual renewable energy auctions. BEP has further commented that they are currently in discussions with various companies based in Korea which are some of the largest energy users in the market.

While the term “RE100 initiative” was a hot topic in Korea’s presidential election last year, it did not draw as much attention as it should have back then – considering the potential impact that the country’s lagged adoption of renewable energy in power market may have on some of the largest energy users. Korea’s industrial sector is the single greatest user of electricity (54% of total countrywide consumption, July 2022, according to KEPCO) and heavily dependent on fossil fuels.

Korea’s energy sector itself is characterised by the dominance of fossil fuels, which in 2018 accounted for 85% of total primary energy supply (TPES), a strong dependence on energy imports at 84% of TPES, and the dominance of industrial energy use at 55% of total final consumption, the highest share among IEA countries. According to IEA, Korea had the lowest share of energy from renewable sources in energy supply among all IEA countries in 2018.

While Korean industries are heavily dependent on the exports, the call for more renewables and transition to clean electricity across the entire value chain has only been increasing from their international customers. As a result, Korea’s largest conglomerates have been competing to secure clean electricity supply while pledges to comply with the RE100 initiative have been simultaneously announced. BEP is set to take advantage of the market situation by working closely with Korea-based large industrial energy users on corporate PPAs and REC supply contracts, as BEP has a portfolio of solar assets that can enter private arrangements.

As in other markets around the world, corporate PPAs have a major role to play in Korea in the face of the great challenge of clean energy transition. However, many industry sources predict that the supply of renewable energy will be short against the increasing demand over the next few years as the Korean government and local authorities continue to fail to ease regulatory bottlenecks such as the infamous distancing rule, which prohibits any kind of solar installations within 500m-1km from residential households and roads.

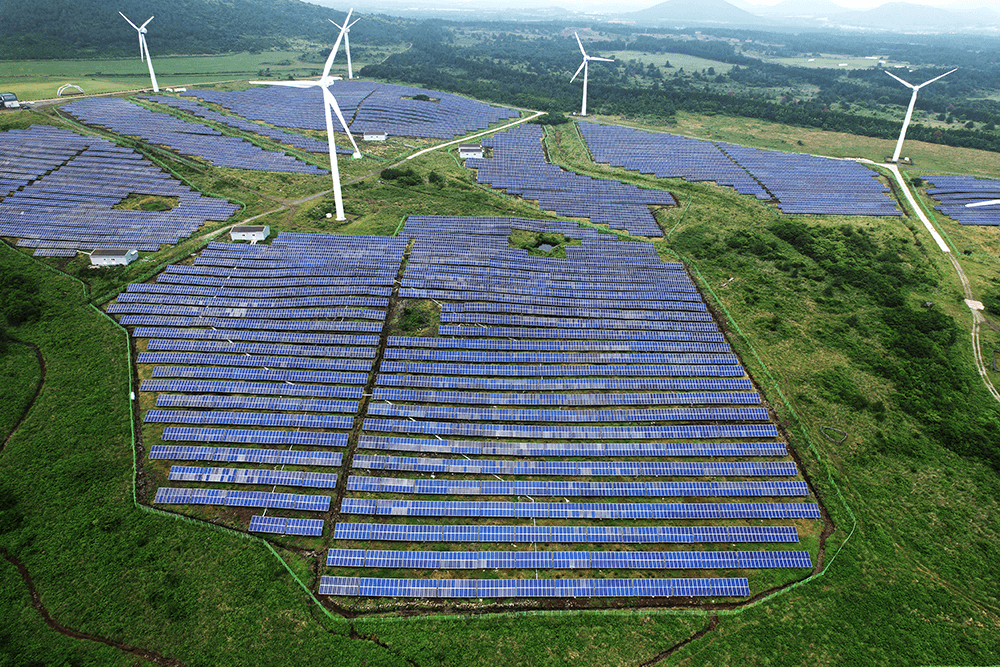

Photo: 13.5MW solar farm in Jeju Island, owned and operated by BEP

Brite Energy Partners on the other hand has been gaining attention as the company owns and operates solar assets as an IPP (Independent Power Producer) and is able to supply clean electricity to off-takers. The company explains that it is differentiated from many players in the Korea renewable energy space, which only brokers assets to potential electricity buyers. The news of BEP entering into a private REC supply contract comes at a critical time when corporate PPAs are yet to take off and the whole industry has been waiting to see progress.

Jin Myung, COO at BEP, commented that “BEP will continue to develop and acquire high quality solar assets so that large industrial energy users based in Korea have a credible way forward to procure clean electricity and to contribute to greenhouse gas emissions reductions,” before adding that “BEP will also strive to help erase unfounded concerns and widespread misconceptions about solar, such as arguing that solar farms are a threat to the country’s nature environment and solar PV is an inefficient source of energy.”

Sources at Mirae Asset Securities commented that “the REC supply contract executed with BEP is an important step forward in our mission to achieve RE100, particularly considering that our investment banking division has established such a significant benchmark in Korea.”

On the other hand, BEP has expanded its business to become a Charge Point Operator (CPO) and successfully launched a new brand in EV fast charging space called “Water”. Water is a fast charging network that is 100% open to all electric vehicle users regardless of the car OEM brands. With its first station open in last November in the capital’s old city center in Gwanghwamun, Water has secured more than 10 sites across the country including Seoul, Daegu and Yangyang, that are being developed to create fast charging hubs housing 6-8 fast EV chargers which provide 200kW-350kW charging speeds.

[ⓒ pv magazine(https://www.pv-magazine.com), 무단전재 및 수집, 재배포금지]